Demystifying Offshore Business Formation: Advantages and Inner Workings Unveiled

In the intricate world of overseas firm development, a veil of mystery typically shrouds the process, leaving many curious concerning the benefits and inner workings that lie under the surface area. As individuals and businesses look for to enhance their financial strategies and safeguard their properties, offshore entities have actually emerged as a preferred selection. The appeal of tax advantages, possession protection, and boosted personal privacy beckons, however just how does one browse this complex landscape effectively? Allow's peel back the layers and explore the engaging reasons behind the expanding rate of interest in offshore business formation, losing light on the systems that make it a strategic alternative for numerous.

Tax Benefits of Offshore Companies

The tax obligation benefits fundamental in overseas firm formation originate from the strategic structuring of monetary properties outside the jurisdiction of one's primary house. Offshore firms typically profit from favorable tax therapy in their picked jurisdiction, which may use reduced or zero business tax obligation prices, no resources gains taxes, and minimized or no inheritance tax obligations. These tax benefits can lead to considerable expense savings for services and individuals operating through offshore entities.

Additionally, overseas firms can participate in lawful tax planning techniques to lessen tax obligation responsibilities better. By making use of tax obligation treaties, transfer pricing arrangements, and other legitimate tax optimization methods, offshore companies can enhance their tax efficiency while remaining certified with pertinent regulations and laws. This adaptability in tax obligation preparation enables overseas business to adapt to changing global tax obligation landscapes and maximize their monetary structures appropriately.

Asset Protection Benefits

Offered the tax obligation advantages of offshore companies, it is necessary to consider the durable possession security benefits that come with such calculated monetary structures. Offshore firm development offers a layer of confidentiality and defense for possessions that can be vital in protecting wealth from possible threats or legal threats. One of the key benefits of offshore entities is the ability to different personal assets from organization responsibilities, protecting personal wide range from prospective business-related dangers.

Additionally, offshore territories commonly have rigorous privacy laws and guidelines, which can improve possession security by making it a lot more difficult for lenders or litigants to access information about the business's assets. Possession protection trusts and structures generally used in offshore territories can supply extra protection by permitting people to transfer properties right into a count on, therefore placing them beyond the reach of future financial institutions.

Privacy and Privacy Factors To Consider

Considering the sensitive nature of monetary info and the importance of protecting personal privacy, discretion and privacy considerations play a crucial role in offshore firm development. By maintaining anonymity, offshore companies can conduct organization with a minimized threat of rivals, litigators, or various other unwanted events accessing delicate info.

Key Steps in Offshore Company Formation

In navigating the realm of overseas firm development, recognizing the essential actions included ends up being critical to utilizing the benefits of heightened personal privacy and discretion defenses used by offshore jurisdictions. The initial critical action in establishing an offshore company is picking the ideal territory. Elements such as legal structures, tax obligation policies, and political stability has to be very carefully thought about. Once a territory is selected, the next action includes conducting due persistance and choosing a credible authorized representative to help with the incorporation procedure. Furthermore, choosing the kind of entity, whether it be a Restricted Liability Firm (LLC), International Business Firm (IBC), or another company structure, is essential in lining up with the desired service objectives. Adhering to entity choice, the submission web link of essential Visit This Link paperwork, such as write-ups of consolidation and investor arrangements, to the appropriate authorities is essential for legal conformity. Lastly, opening a company financial institution account in the selected jurisdiction and preserving exact monetary documents are vital actions in solidifying the overseas firm's establishment.

Usual Misconceptions Exposed

Despite prevalent myths surrounding overseas firm formation, an extensive understanding of the process can dispel misunderstandings and highlight the genuine advantages of establishing an overseas entity. One usual false impression is that overseas business are only for the wealthy or for involving in immoral tasks. In truth, offshore company development is a lawful and widely used approach by organizations of different sizes to optimize their economic operations, safeguard assets, and promote worldwide trade. An additional mistaken belief is that offshore companies are developed entirely to evade tax obligations. Offshore Company Formation. While tax optimization is a legitimate factor for establishing an overseas entity, it is not the only function. Offshore companies supply benefits such as enhanced personal privacy, asset defense, and access to international markets. Additionally, offshore territories have strict guidelines in position to stop money laundering and ensure conformity with international legislations. For that reason, comprehending the true nature and benefits of overseas company development can aid services make educated choices for their economic strategies.

Conclusion

Offshore companies commonly profit from favorable tax therapy in their picked jurisdiction, which may provide reduced or absolutely no corporate tax rates, no resources obtains taxes, and decreased or no inheritance tax obligations. By making use of tax obligation treaties, transfer pricing arrangements, and other legit tax obligation optimization approaches, overseas companies can improve their tax performance while continuing to be certified with relevant legislations and guidelines. It is crucial to note that while offshore jurisdictions provide robust personal privacy protections, conformity with international regulations like anti-money laundering measures is crucial to make sure the authenticity and sustainability of overseas frameworks.

In navigating the realm of offshore company formation, understanding the pivotal actions entailed comes to be extremely important to using the advantages of enhanced privacy and privacy protections provided by overseas jurisdictions.Despite prevalent misconceptions surrounding offshore company development, a detailed understanding of the procedure can eliminate mistaken beliefs and highlight the genuine advantages of developing an overseas entity.

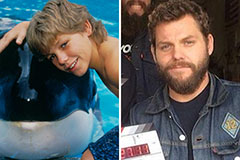

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!